A QUALITY underlay is a vital component of the stretch fit installation infrastructure and offers genuine tactile and physical benefits like;

- Underfoot Comfort

- Carpet Protection

- Appearance Retention

- Acoustic Suppression

- In room ambience

- Heat Insulation

- Energy Absorption

- Floor Levelling

And, of course, seller profitability!

But many people don’t see these benefits. They see underlay as an enigma – unseen, a commodity with few benefits, a pain to store and lift! Never mind the benefits – what’s the price?

Yet those of us who have spent much of our working lives making and selling the product see things differently. Under carpets, underlay really does provide genuine tactile and physical benefits with the further ‘plus’ that it is a significant profit maker. Perhaps it’s time to start looking at this apparent enigma as an ‘unseen hero’?

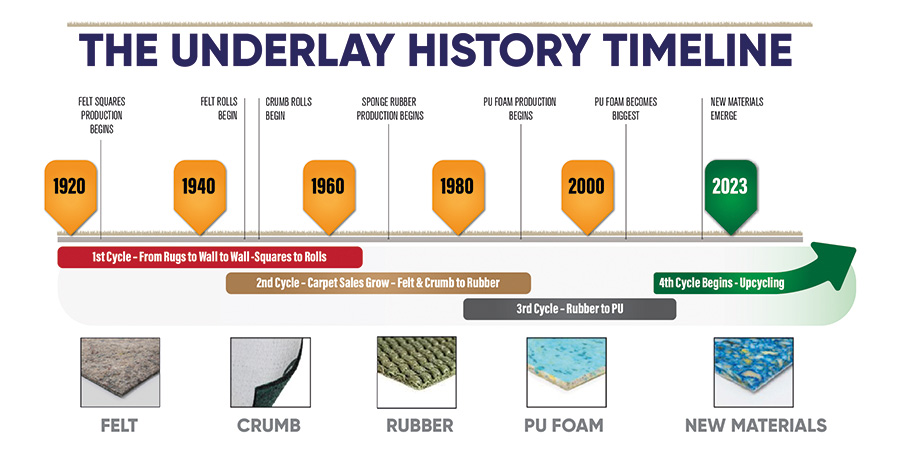

The underlay market is a fascinating case study in terms of both product development and marketing. Product types have developed in 3 distinct cycles over the last 75 years in terms of materials used, manufacturing, attributes and application. It’s a science in its own right.

But part of the fascination of underlay is about the ‘business science’ that envelops the marketing of a commodity – how do you make a bit of foam, felt or rubber interesting and relevant to trade and consumer? Commodities like underlay may seem boring, but when you have to build brand and perception around a nominally unseen product that people will only touch at point of sale it becomes a marketing challenge and a lot of fun!

A Quick History – Underlay Products and Marketing

Felt Underlay started out under woven area rugs in the early 20th Century, but only really got volume going in the early 1950’s when a typical household would have a large area rug in the living room and linoleum around the perimeter.

The prevalent rug size was 12’ x 9’ or 9’ x 6’ and the idea of having a felt underlay to reduce slippage and add comfort took off. Companies like BMK made felt underlays predominantly at 9’ width, pioneering the use of ‘bounce’ and ‘spring’ in underlay marketing.

As the 50’s wore on, Roy Roberts invented carpet gripper and more broadloom carpets became available, both combining to create the concept of ‘Wall to Wall Carpeting’. Large squares of felt were not suited to wall to wall and smaller roll sizes for easier handling and less waste were developed by cutting the 9ft felt width in two. This produced the 4’6’’ wide underlay width that became a ‘norm’ that continues to this day.

Ever wondered why most underlay is 1.37m wide? Now you know!

Around this time crumb rubber from used car tyres was reformed into a highly resilient underlay for the first time by the Durie & Miller company, their Super Duralay vying with Felt for market leadership. Felt and Crumb are still used in underlay manufacturing today with the added benefit of using recycled materials in their manufacture, still at 4’6’’ wide, but unchanged because 3 widths cover today’s 4m widths with little waste!

Into the 60’s, the marketing of carpets became more intense with brands like Kosset leading the way. Sales grew rapidly and the industry realised that underlay had real benefits in terms of helping appearance retention in addition to adding comfort. In combination with its potential as a resilient material, sponge rubber made its market entry, enabling underfoot comfort as never before. Over time, sponge gradually replaced felt and crumb as the leading product type. The sponge rubber brand name Tredaire grew to become a household name in the 70’s as we saw the marketing tactics used by the tufters replicated under the carpet. Every self-respecting middle-class home had Tredaire!

Duralay, Ball & Young and Airstep joined the sponge rubber battle in the 80’s and the marketing of carpet underlay direct to the consumer as a ‘must have’ enabled rapid growth alongside an explosion in the sale of tufted carpets.

But the dominance of sponge rubber was about to be challenged ……

In the late 80’s, the Vita company began marketing an underlay made from reformed polyurethane derived from their prime foam cutting waste. In its earliest format its’ somewhat ragged appearance made little impression on the underlay market, but this was the pre-cursor of things to come!

In the 90’s, Vita acquired Ball & Young and sold their reformed polyurethane underlays alongside sponge rubber. They developed the PU product to look better than previous iterations and marketed its underfoot comfort to rival the sponge rubber products of Tredaire and Duralay. The Cloud 9 brand grew into the name we all know today and, into the 2000’s, sponge rubber gradually declined and reformed polyurethane was eventually produced by 4 different manufacturers to dominate the market for carpet underlays.

In the early 2000’s, as hard flooring began to grow with the development of click flooring types, a new underlay market developed in the suppression of impact and airborne sound under products like laminates, where they also had a levelling benefit. The scientific side of product development once again came to the fore and new uses under hard floors were found for the sponge and crumb rubber that became less popular as carpet underlay types. Acoustic suppression is now a key aspect of the market and a new expression of the science of underlay.

As carpet sales decline against hard flooring types and the need for post-consumer recycling grows, the underlay market faces new challenges as it enters its 4th clear development and marketing cycle.

The Post Consumer Challenge

Because the tactile, performance and acoustic attributes of underlays are genuinely important but completely unseen, they are ideal candidates for the use of post-consumer recovered materials that can be upcycled into underlays whose looks are less important than their function.

Going forward, the underlay industry can look to its past as the starting point to define its future.

The use of carpet fitting waste and remnants is already producing felt underlays using the same production methods deployed in the early stages of underlay history. Can methods be developed to utilise post-consumer carpets as an upcyclable underlay material? If so, the traditional felt of the early underlay days has an important role to play in its future.

Crumb Rubber sourced from car tyres was around from the beginning and has been a post- consumer material option for underlay manufacture since the 1950’s. Vulcanised rubber is difficult to chemically break down, so the only options to landfill are crumb applications like running tracks, playground safety floors and underlay. Acoustic underlays are the ideal medium for crumb and until materials to replace rubber in tyres is developed, there will always be a need to avoid the landfill of materials that take decades and more to degrade.

The reforming of polyurethane foam into an underlay was a clever idea to put industrial waste to good use. Ideas that make money usually succeed in the flooring industry and reformed PU foams have dominated the industry for many years. But what happens to polyurethane foam underlays after their useful life?

Crumb Rubber is genuinely post-consumer; however, today’s polyurethane underlays rely on the continuing production of prime polyurethane foam using oil-based chemicals to enable the availability of the offcuts that make polyurethane underlays. Some believe that we should no longer consider the use of prime industrial waste as recycled material and PU Foam’s dependence on chemicals derived from fossil fuels puts a question mark on the long- term future of this production route.

Over the last two years, new post-consumer recovered materials have started to make their mark on the underlay industry. New materials including recovered PET drink bottles and reclaimed polyurethane foams have emerged to play their part in the next cycle of the science of underlay.

Foams recovered from the likes of post-consumer soft furnishings, mattresses, bus seats and underlays are now being used to produce a new upcycled underlay type that looks set to evolve into a viable alternative to the use of waste sourced from prime. These new types are now coming on to the market.

The Science of Underlay Evolves

The next underlay cycle is may not be solely focussed on the product development and great marketing that has made the underlay industry what it is today. The focus is likely to shift to the cost-effective collection and upcycling of post-consumer waste to create the planet friendly underlays of the future.

Far from being an enigma, boring and commodious, underlay is a fascinating product, a fascinating industry and has the potential to play its’ part in a greener future for the flooring industry.